Reduce signing times, Improve user experience and Streamline Business

Signatures are critical for completing a wide range of documents. With paper-based signatures, however, a lot can go wrong, and often does. Faxes don’t go…

Signatures are critical for completing a wide range of documents. With paper-based signatures, however, a lot can go wrong, and often does. Faxes don’t go…

The story of Rodney Rodney has a non-working wife and two adult children, one who is studying and the other who has left school but…

An Australian resident is required by law to declare any foreign income in their Australian tax return, irrespective of whether it is assess-able or exempt….

The deadline is looming for the submission of your 2014 tax return. For most people lodging via a tax agent the deadline is 15 May. …

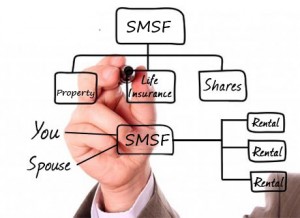

We hear about Self-Managed Super Funds (SMSF) everywhere from general business meetings to networking to family get togethers. Often they come up as topic of…

Starting your own business is often a scary and intimidating process and requires a number of decisions to be made prior to starting. One of…

Having to lodge a BAS (business activity statement) is something that most business’ need to do. However the lodgement frequency could be monthly, quarterly or…

End of content

End of content

Get money tips, tricks and insights delivered directly to your Inbox from our experts

Liability limited by a scheme approved under Professional Standards Legislation

© 2023 Proactive Accounting & Financial Services Gold Coast. Website Designed & Developed by Ignition Media